bad credit home loan interest rates: what to expect and how to improve your offer

Understanding the spread

Lenders price mortgages by risk, so borrowers with late payments, high utilization, or limited history often see higher rates than prime customers. Factors like credit score tiers, loan-to-value, debt-to-income, property type, and cash reserves all push pricing up or down. Government-backed options such as FHA can soften costs, but risk-based adjustments still apply.

Practical example

On a $300,000 30-year fixed, a well-qualified buyer might pay about 6.5% (around $1,900 monthly principal and interest), while a 610–640 score could see 8.25% (roughly $2,250). That gap-about $350 each month-adds up to thousands a year, illustrating why even a small improvement in profile matters.

Ways to lower your rate

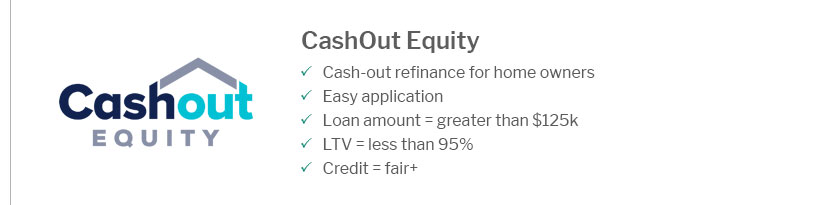

- Boost your down payment to reduce LTV and mortgage insurance.

- Pay down revolving balances to drop utilization before underwriting.

- Shop multiple lenders the same week and compare APR, not just the note rate.

- Evaluate discount points; prepaying interest can make sense if you’ll keep the loan.

- Stabilize income, document assets, and lock strategically when markets dip.

Request a written loan estimate for apples-to-apples comparisons, and revisit quotes after any credit score bump.